As Australia’s most trusted payment provider, PayPal can help grow your business. 1

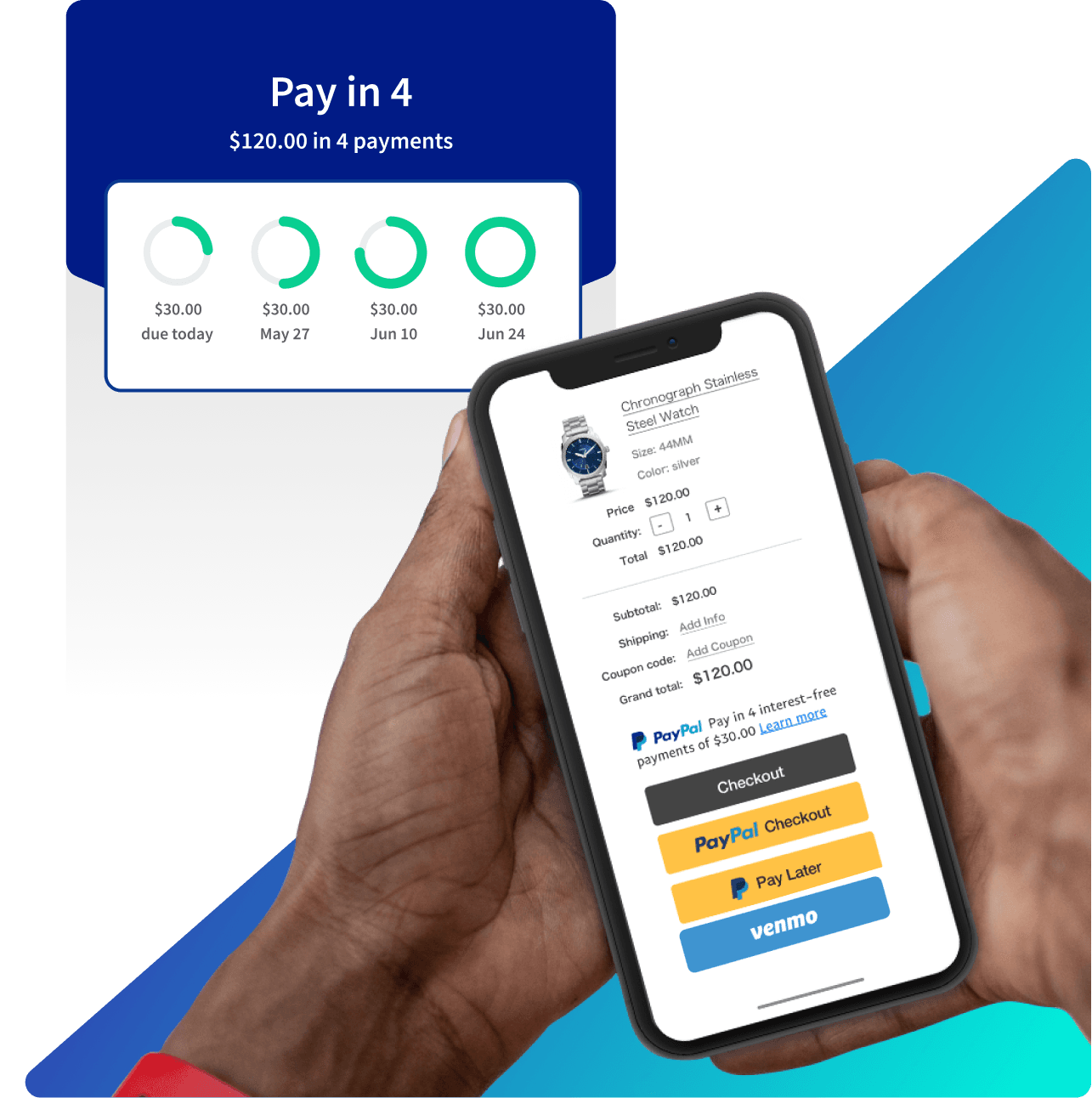

Consumers are more than twice as likely to complete their purchase when PayPal is available at checkout.1 Offer more payment options with a secure all-in-one payments solution for your BigCommerce store. With the latest PayPal Checkout, your customers can pay with PayPal, PayPal Pay in 4* and credit and debit cards, on any device – all with one seamless checkout experience.

*Terms apply.

Not yet using BigCommerce?

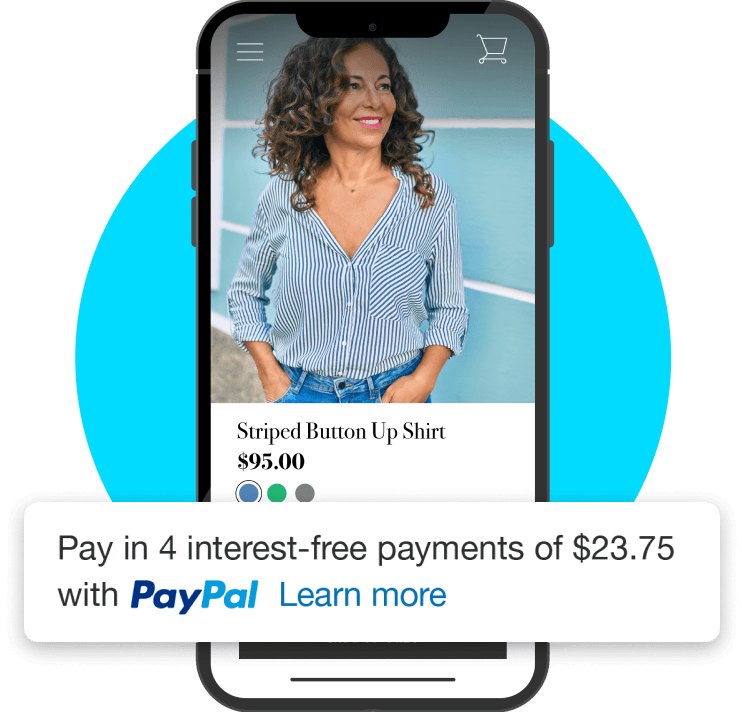

Turn browsers into buyers with PayPal Pay in 4

PayPal Pay in 4 is included in PayPal Checkout, and allows customers to pay over time while you get paid up front – at no additional cost to your business.2 And since 81% of younger consumers decide which payment method to use before they get to checkout,3 adding dynamic PayPal Pay in 4 messaging could help you increase conversions4, boost average order value (AOV) and encourage customers to buy more.5

Pay in 4

4 interest-free payments over 6 weeks.**

**First payment due at purchase plus 3 fortnightly payments

Go global.

Make it local.

With country-specific payment methods, you can reach international customers while making your business feel local. Built trust and offer local payment options available to your international customers.

Take charge.

Add all major debit and credit cards to your all-in-one solution. It’s easy to manage and we handle the processing.

59%

of Australian consumers are more likely to use a BNPL service from PayPal than the nearest competitor6

68%

of BNPL users are more likely to complete a purchase if a buy now, pay later option is available.7

100%

PayPal Pay in 4 has driven a 100% increase in average order volume compared to PayPal’s standard average order volume.8

Offer customers PayPal – one of the world’s more trusted brands.

More than half of consumers say they place more trust in businesses that accept PayPal.9 In fact, 81% of Australians trust PayPal to keep their payments secure.10

20+

years of experience

200+

markets around the globe

100+

different currencies

PayPal helps you protect your business with fraud protection.

With 1 billion monthly transactions11 and the intelligence from our global network of buyers and sellers, PayPal’s fraud detection tools get smarter.

Your business could be eligible for fast access to funding

PayPal Working Capital is a business loan primarily based on your PayPal account information, so no external credit check12 is required. Loans range from $1,000 to $230,000 for first time applicants and up to $350,000 for subsequent applicants.13

Fast funding if you’re approved

There’s no time-consuming application or check of your financial history. Approved loans are funded in minutes.

Repay as you get paid.

You repay your loan balance automatically using a percentage of your daily sales, which you choose during the application. There are no added charges if your sales fluctuate and on days with no sales, you pay nothing.14

No hidden fees

Don’t worry about periodic interest or hidden fees— You pay just one fixed fee that PayPal details upfront in your offer, which means there are no additional fees to worry about.15

Disclaimers:

1. PayPal Australia eCommerce Index 2022 (commissioned by PayPal Australia)

2. Availability is subject to merchant status and integration, consumer eligibility and terms. Product provided by PayPal Credit Pty Ltd. See product terms for details. Usual PayPal merchant fees apply.

3. 81% of Millennial and Gen Z BNPL users decide which payment method to use before checkout. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among Millennial & Gen ZBNPL users (ages 18-40), US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255)).

4. 62% of BNPL users say that seeing a buy now, pay later message while shopping encouraged them to complete a purchase. TRC online survey commissioned by PayPal in April 2021 involving 5,000 consumers ages 18+ across US, UK, DE, FR, AU (among BNPL users, US (n=282), UK (n=303), DE (n=342), AU (n=447), FR (n=255))

5. PayPal earnings report, May 2021. Q1-21 results include Pay in 4 (US), Pay in 3 (UK), PayPal Ratenzahlung (Germany), and Paiement en 4X (France).

6. ACA Research, PayPal Australia eCommerce Trends Report 2021 (commissioned by PayPal Australia).

7. TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1000 consumers ages 18+ in AU. (among BNPL users, n =447).

8. Based on PayPal internal data from Q1 2022, results include PayPal Pay in 4 (AU).

9. PayPal Australia eCommerce Index 2022 (commissioned by PayPal Australia)

10. ACA Research, PayPal Australia eCommerce Trends Report 2021 (commissioned by PayPal Australia).

11. PayPal internal data, 2020

12. No credit check with credit reporting body. PayPal will conduct a risk assessment using internal PayPal merchant account data including account and sales history.

13. Loan provided by PayPal Credit Pty Ltd (ABN 66 600 629 258). Eligibility and loan value are based on internal data including PayPal sales and account history at time of application. See full terms: paypal.com/au/workingcapital/terms.

14. Subject to minimum repayment requirement every 90 days. Funds must not be diverted while loan is open.

15. Usual PayPal fees and charges for a business account apply, see paypal.com/au