Explore the

BigCommerce platform

Get a demo of our platform to see if we’re the right fit for your business.

Not ready for a demo? Start a free trial

The Importance of Value-Based Pricing Strategy and Why You’re Likely Selling Your Products Short

Patrick Campbell

There are endless ways to configure pricing for your online business, but many pricing strategies leave revenue on the table and can even damage your customer’s view of your brand.

If you’re not pricing correctly, you could unwittingly tank your business. This is because not all pricing strategies put the customer first. As an online business, finding the right formula for retail markup is one of the most important questions to solve for.

Value-based pricing is potentially the best pricing strategy for your brand, your customer relationships and your bottom-line — but as with most worthwhile endeavours, it isn’t considered “low-hanging fruit.”

This is why most companies turn to sub-par pricing strategies like cost-plus pricing and competitor-based pricing.

The Downside of Cost-Plus Pricing Strategy

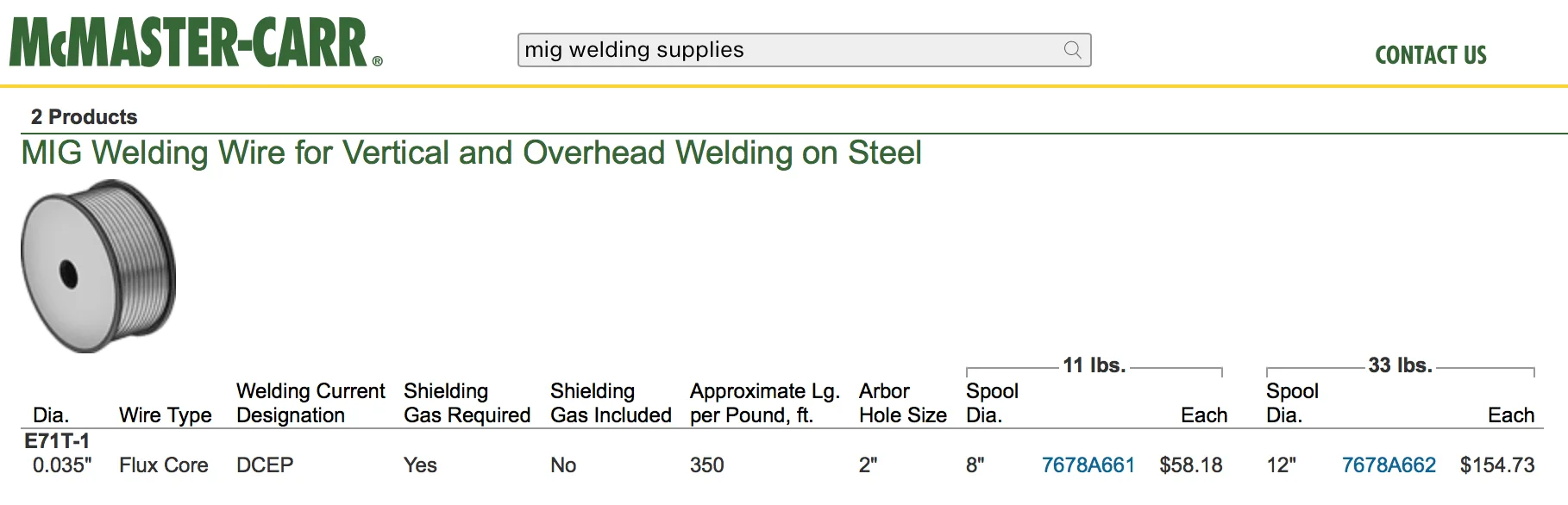

Cost-plus pricing is an outdated but nonetheless popular pricing strategy.

It works by simply taking the cost of production and adding a fixed margin to create the retail price. McMaster-Carr, an online industrial parts retailer, uses a cost-plus pricing scheme to ensure that the company makes at least that margin in profit on items that have high production and shipping costs.

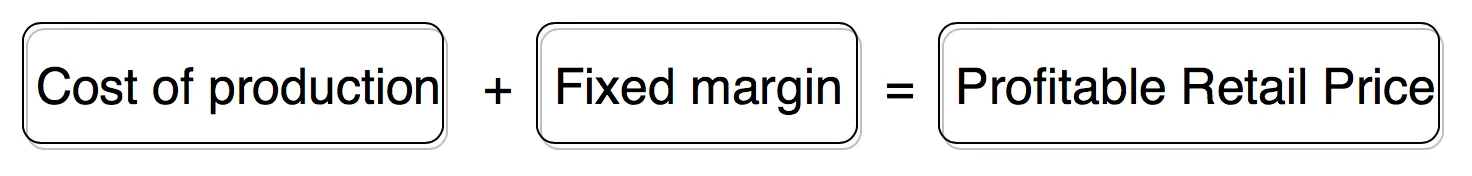

Yet cost-plus pricing is problematic because it completely disregards the customer’s perspective. They don’t care about cost of production or what profits you’re looking to make to hit your annual goals. They care about how your product helps them, and ultimately they want to pay what they think it’s worth. The formula for cost-plus pricing retail markup is as follows:

The price a customer wants to pay may end up being the cost of production plus a margin. But depending on the value the customer is getting from the product and from the experience of purchasing from your company, it might not shake out that way.

You could end up overcharging or undercharging your customers, which is bad for both your company and your customers.

The Downside of Competitor-Based Pricing

Companies may also resort to competitor-based pricing. Competitor-based pricing relies on checking to see what prices similar companies have published for their products and then pricing your products similarly.

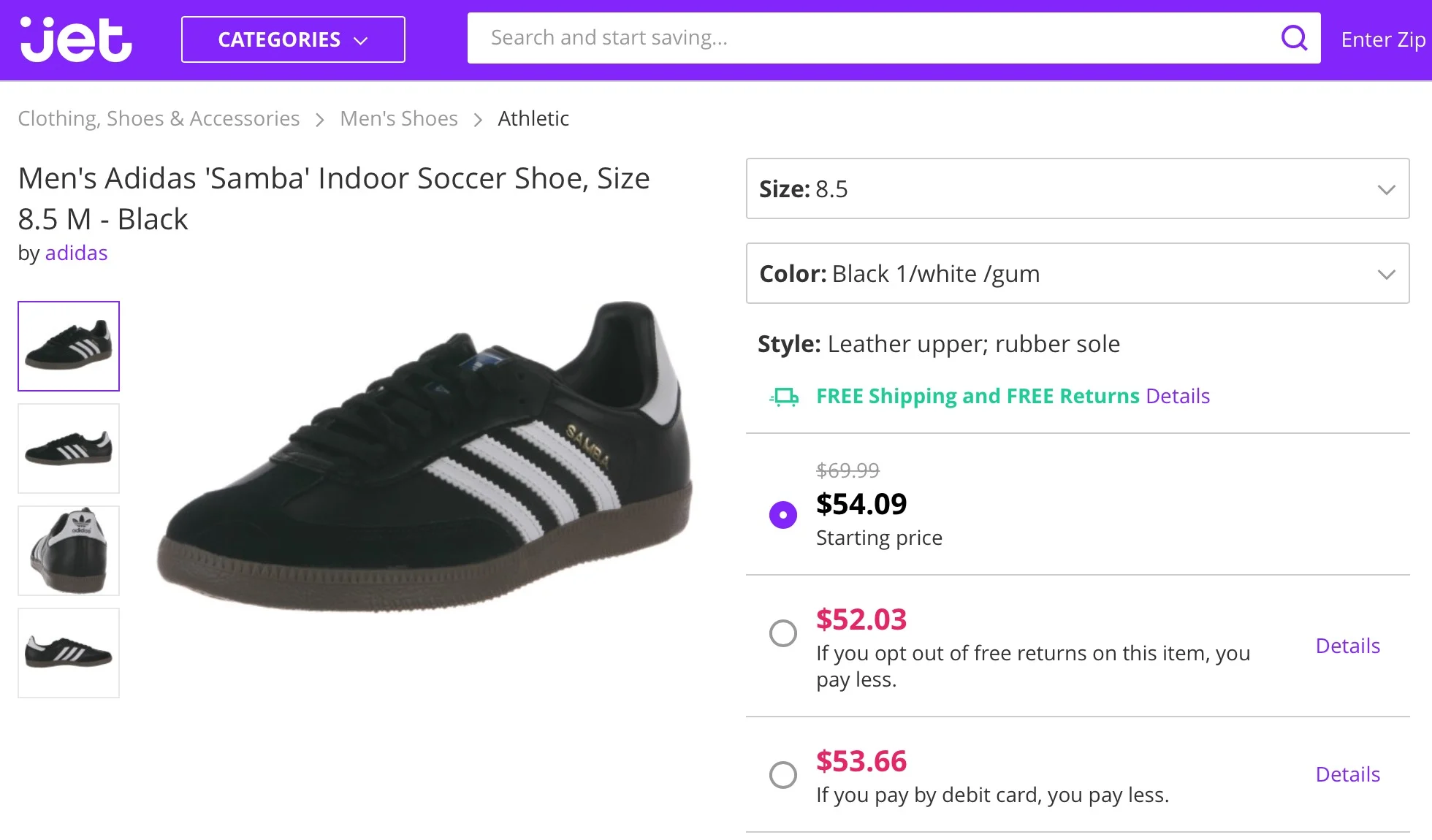

For instance, Jet claims that their prices are at least 10-15% below any other prices for that item that you’ll find online. They offer significant discounts and price slashes in their race-to-the-bottom to substantiate that claim.

Competitor-based pricing assumes your competitors have done the work that you don’t want to do to create a good strategy. But they might not have done it either.

That means you’re not just a copycat — you’re likely to tank along with your competition due to a shoddy pricing scheme.

What is Value-Based Pricing?

There’s only one way to make sure that you’re not losing money and customers: value-based pricing.

Value-based pricing ensures that your customers feel happy paying your price for the value they’re getting. Pricing according to the value your customer sees in your product prevents you from short-changing yourself while creating an experience for customers that’s most aligned with their expectations.

You’ll also strengthen your brand name, build better customer relationships, and ultimately improve your bottom line. Value-based pricing is the only true win-win scenario for you and your customer.

But first, what is value-based pricing, and how do you compute this type of retail markup?

Identifying a Value-First Pricing Strategy

A value-based pricing system charges customers according to the value the customers receive from a product.

A successful value-based pricing system aligns with what the customer is willing to pay for a product that delivers the solution they need.

Why does this matter?

Because customers that are happy to pay for the value they receive are customers that retain and buy again. One study found that increasing retention by 5% can increase profits by up to 125%.

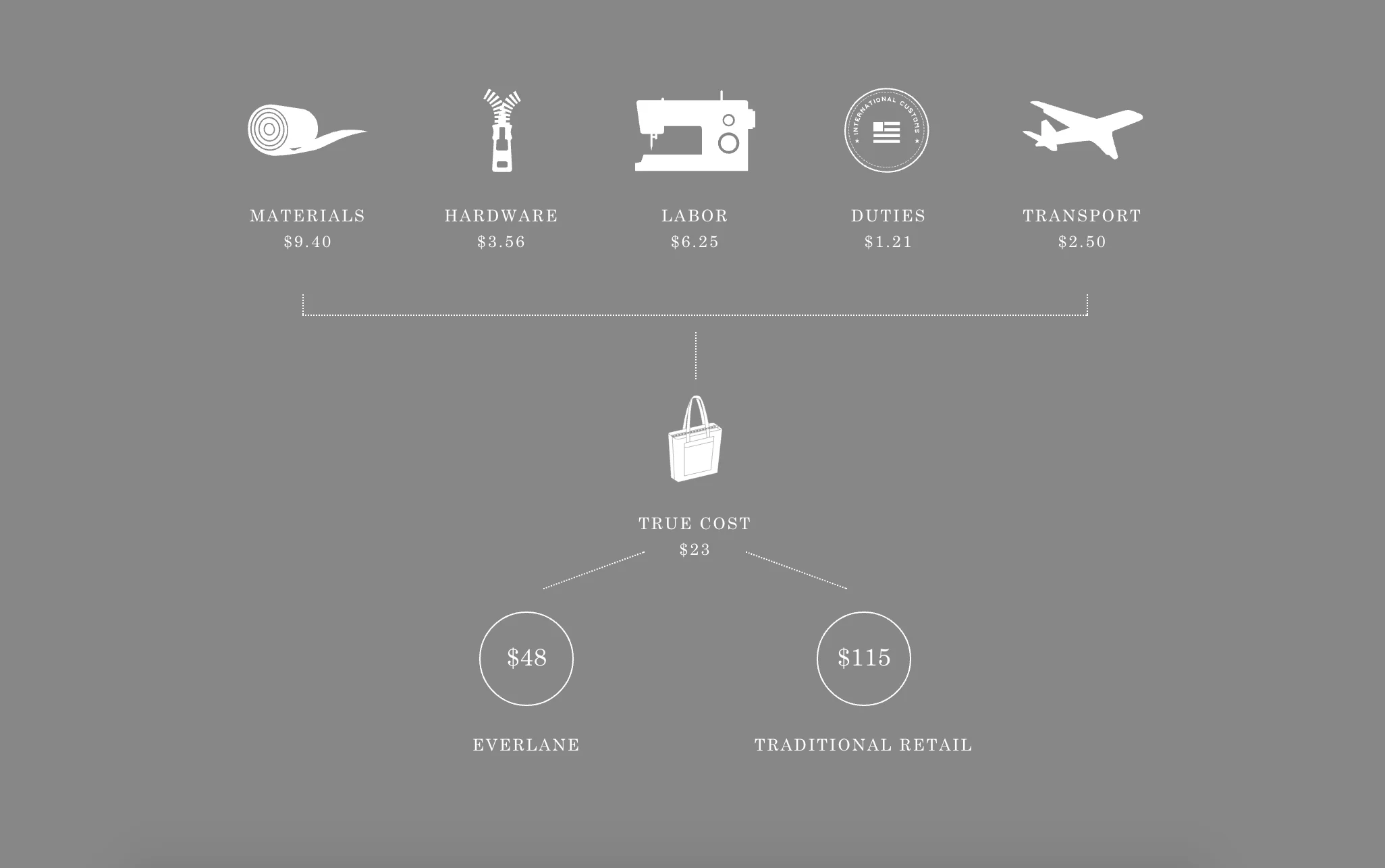

Everlane, an ecommerce clothing company, has developed a pricing strategy that demonstrates how effective value-based pricing can be in strengthening a brand, winning customer trust, and bolstering profitability. Everlane describes their pricing as “radically transparent.”

It is part of the company’s mission to communicate about the factories where their clothes are made, the true cost of producing the clothes, and their open feedback policy.

Everlane openly charges customers more for the clothing than the clothing’s cost of production. Yet the price is based on the value that customers are receiving:

The clothing item itself

The ethical assurance of supporting good factory relationships

The experience of purchasing from a trustworthy company

Customers feel good about their purchases, and they’re happy to pay Everlane’s prices for the value they receive.

How to Execute on a Value-First Pricing Strategy

1. Identify Who Your Customers Are By Creating Buyer Personas

The key to value-based pricing is creating quantified buyer personas.

Buyer personas are representations of the largest and most ideal sections of your market. They can be sketches of hypothetical buyer identities, like MailChimp’s creative personas.

We want to advocate for getting as specific and quantitative as possible with these.

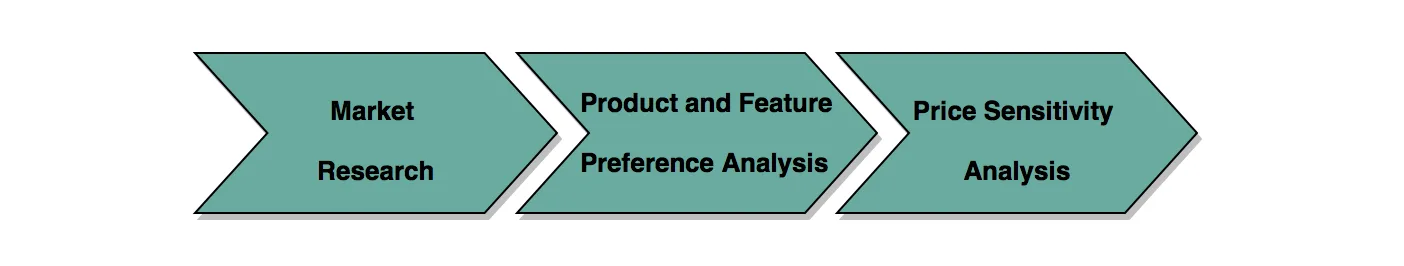

At Price Intelligently, we use a three-step framework that any ecommerce company can adopt to quantify their buyer personas:

Market research

Feature and product preference analysis

Price sensitivity analysis

You can also flesh out your personas with more data, more specificity, and more qualitative information. This could include how likely they are to respond to discounts and what other products they might be interested in.

BigCommerce Analytics

BigCommerce stores can use their BigCommerce Analytics Customer Report to see which customers are buying which items –– and which prices. Then, you can easily create customer groups to personalise a cohort’s site experience based on their behaviour.

In other words, do you have a group of people who only buy at discount? Customise their experience to show discounted prices across the board. Do you have customers who only purchase new items? Send that cohort an email alerting them to new products before anyone else –– and use the customer group to give them a VIP experience.

Start with this three-step framework, which will provide the foundation you need to create the richest and most meaningful buyer personas.

2. Conduct Market Research To Learn About Customer Demographics

The market research step involves collecting demographic information on your customers.

This may include information like age, job, and location. It can also include information that’s more specific to your particular ecommerce company and your products:

Motivation to buy

Interests (related to your product or otherwise)

Concerns about your products

Concerns about your company

Preferred products from competitor’s companies that you do not sell

Preferred method of communication / form of social media

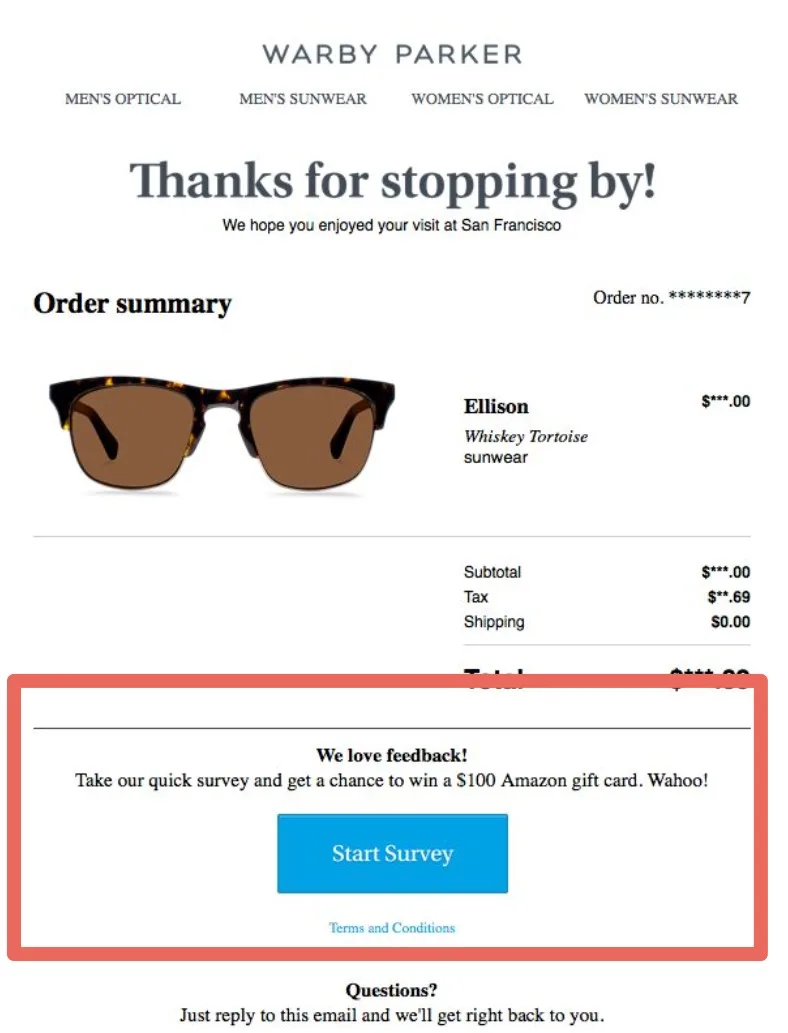

Consider surveys within your nurture stream and receipt surveys to collect more general information. A tool like Survey Monkey will help you build questionnaires for feedback. Other tools, like Promoter.io, make it possible to incorporate surveys into emails.

Warby Parker incentivises customers to complete their email receipt survey by entering the customer into a contest for a $100 Amazon gift card when they complete the survey.

Money spent on incentives like contest prizes or complimentary items isn’t wasted— it’s an investment. The money you spend on survey incentives could save you up months of development time by nailing your customer personas early on.

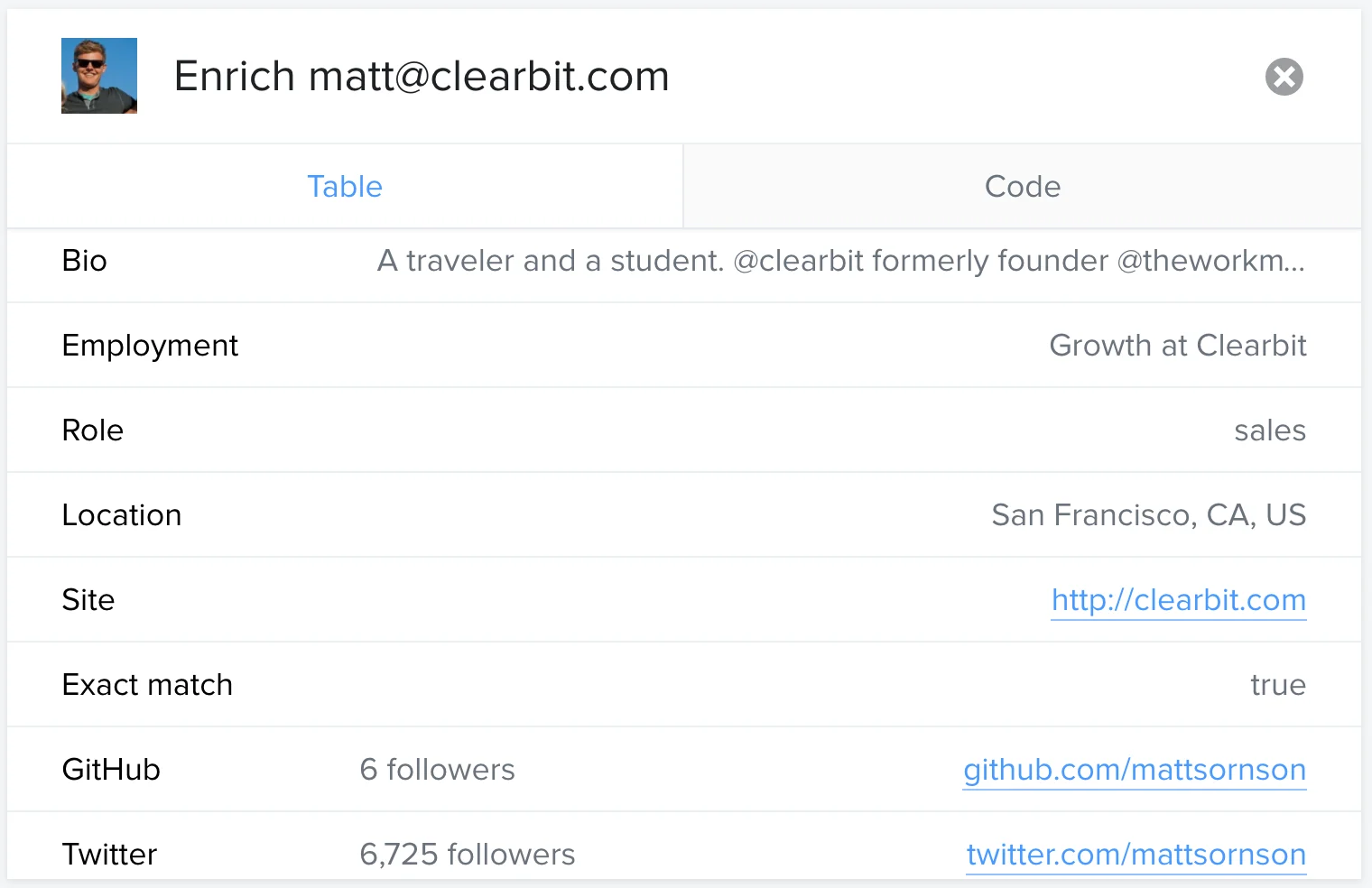

To dig into more specific information, you may benefit from using tools such as Facebook Audience Insights or Google Analytics Audience Reports to see the type of people that are visiting your site.

To delve into more actionable information about your best customers, something as simple as an email address can convert into a wealth of customer information. Chrome extensions like AeroLeads and Clearbit, a data enrichment tool, can take an email and turn it into a trove of useful information about that person.

Tools are useful for bolstering survey responses — though asking the customer is always the most direct research method.

Lastly, try some organic digging: Go to your competitor’s blogs and social media sites and see who is liking and commenting on their material. Then look deeper into your competitor’s customers to learn more about the broader market.

This is especially useful if your ecommerce company is young and you don’t have a large customer base yet to survey.

3. Conduct Feature and Product Preference Analysis to Gauge Value

Once you begin to sketch out who your customers are and what motivates their interests in your company, you can look closer at their perspectives on your product.

It’s important to know what products certain customers value most. But asking them to “rate a product’s value on a scale of 1-10” can be frustrating and arbitrary for you customers — and for you when you try to interpret those numbers.

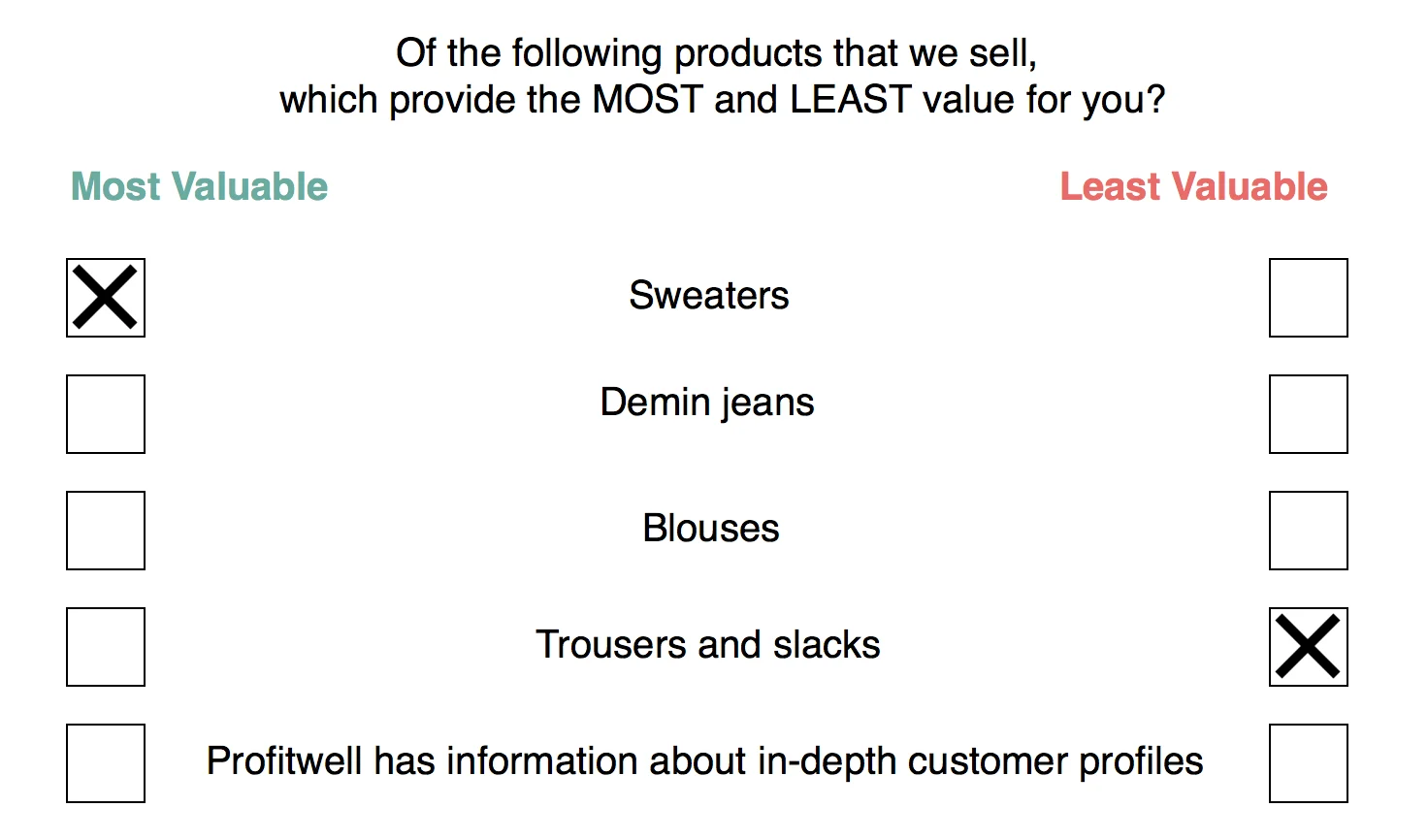

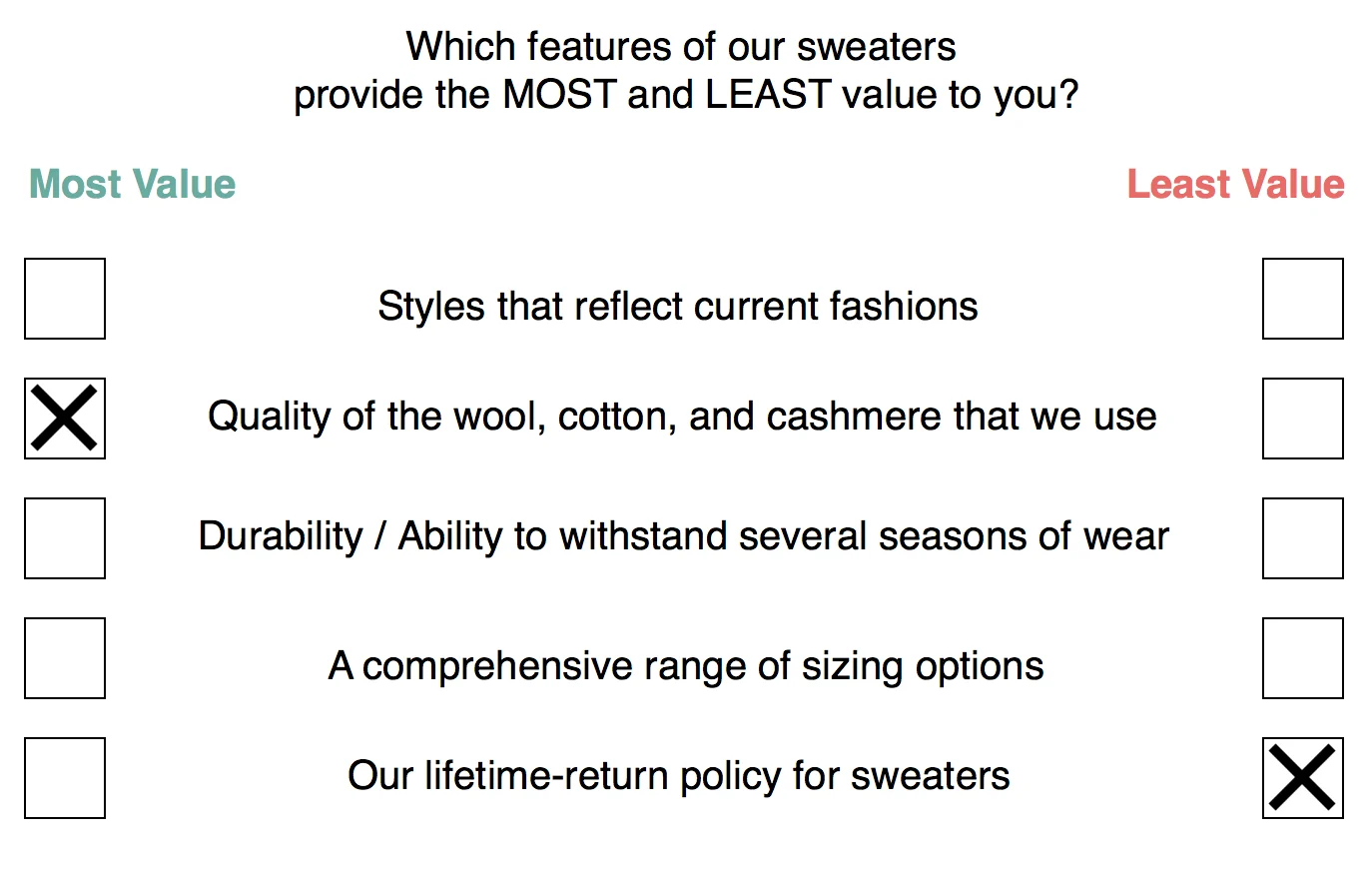

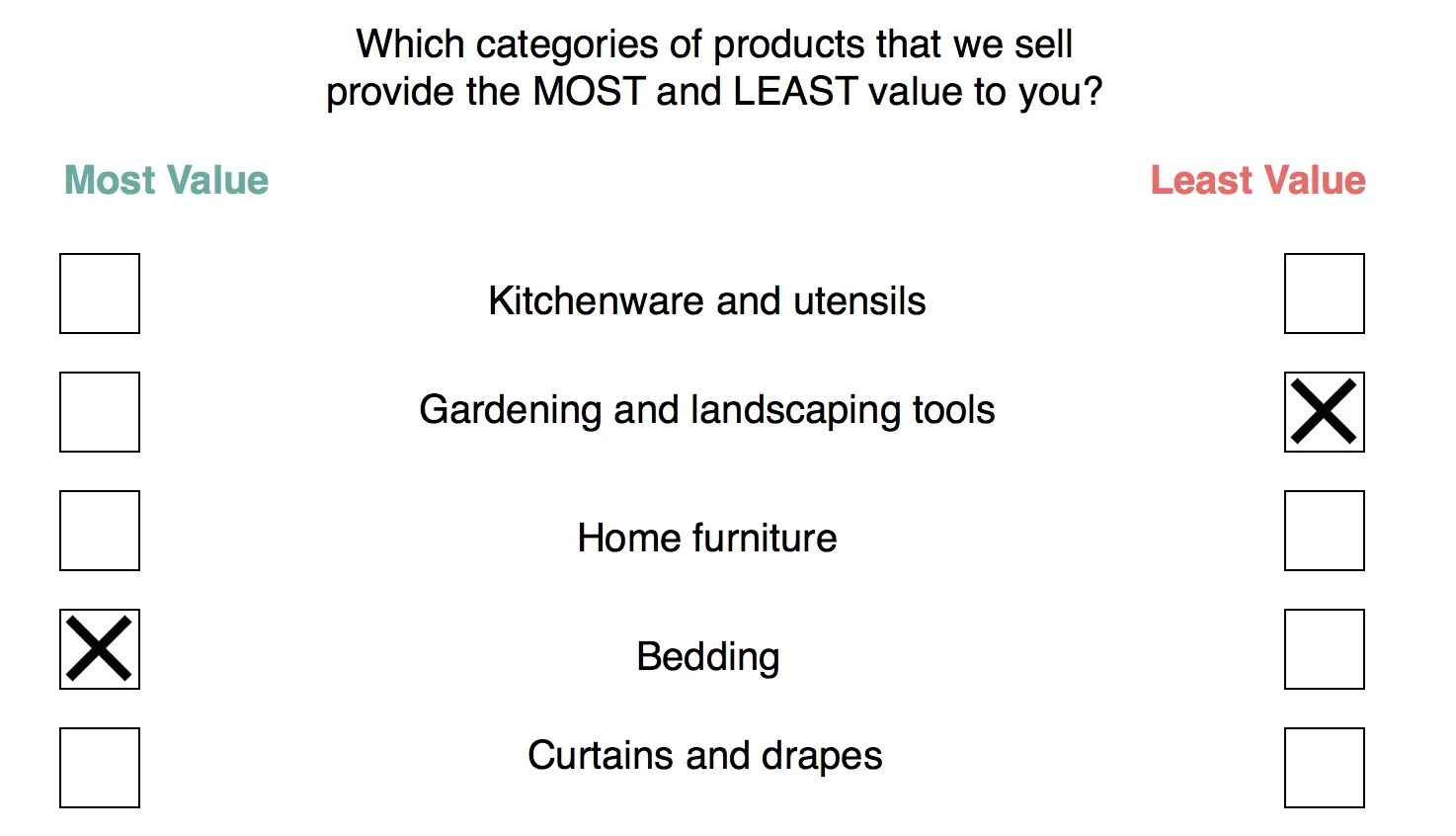

A better way of asking for your customers’ preferences is to use Max Diff analysis. Present your customer with several choices, and ask them to choose the one that provides the most value and the one that provides the least value.

You can perform a two-step Max Diff Analysis by first asking your customers to choose their most/least valuable products, and then asking them to choose the most/least valuable features about those products.

For instance, if your ecommerce store sells women’s clothing, the first Max Diff survey might look like this:

A follow-up Max Diff survey might then look like this:

By segmenting customer responses based on the loose sketches you determined from your market research, you’d conclude that women aged 18-25 with an interest in eco-friendly clothing production find the most value in your company’s sweaters. They particularly value the high quality of the materials used to make the clothing.

From these conclusions, you could take the following actions:

Implement an increase in the prices of your cashmere sweaters to reflect the value that a large portion of this buyer persona finds in this product.

Emphasise the quality of material and the ethical production of your clothing in your marketing copy and advertisements.

If your company offers hundreds or thousands of items, it would be impractical to feature every item in your surveys. In this case, segment your inventory by category and conduct a preference analysis about broader categories.

You can then create more specific Max Diff surveys within categories where certain customers find the most or least value. For instance, you might create a survey about different types of bedding for this buyer persona.

4. Conduct Price Sensitivity Analysis to Find Concrete Price Points

The most important step in creating value-based pricing is collecting feedback on real price points that customers are willing to pay.

Willingness to pay is a reflection of the value that customers see in your products, so it’s your best gauge when determining your value-based pricing scheme.

A successful price sensitivity analysis rests on foundation of strong market research and feature/product preference analysis. Your market research will tell you how to segment customers when asking them about price points, and your preference analysis will help you determine which products are most important to ask about.

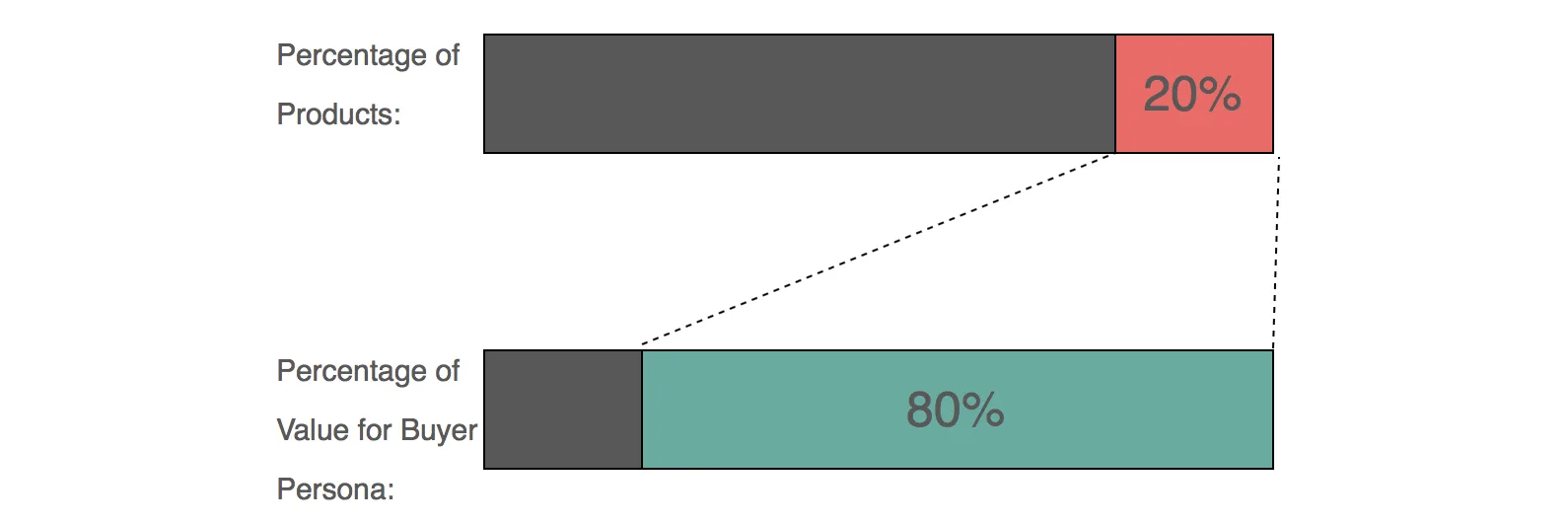

When conducting price sensitivity analysis, use the 80/20 principle: focus on the 20% of your products that provide the most value for 80% of a buyer persona. This will save you from conducting a price sensitivity analysis on an unreasonable number of products.

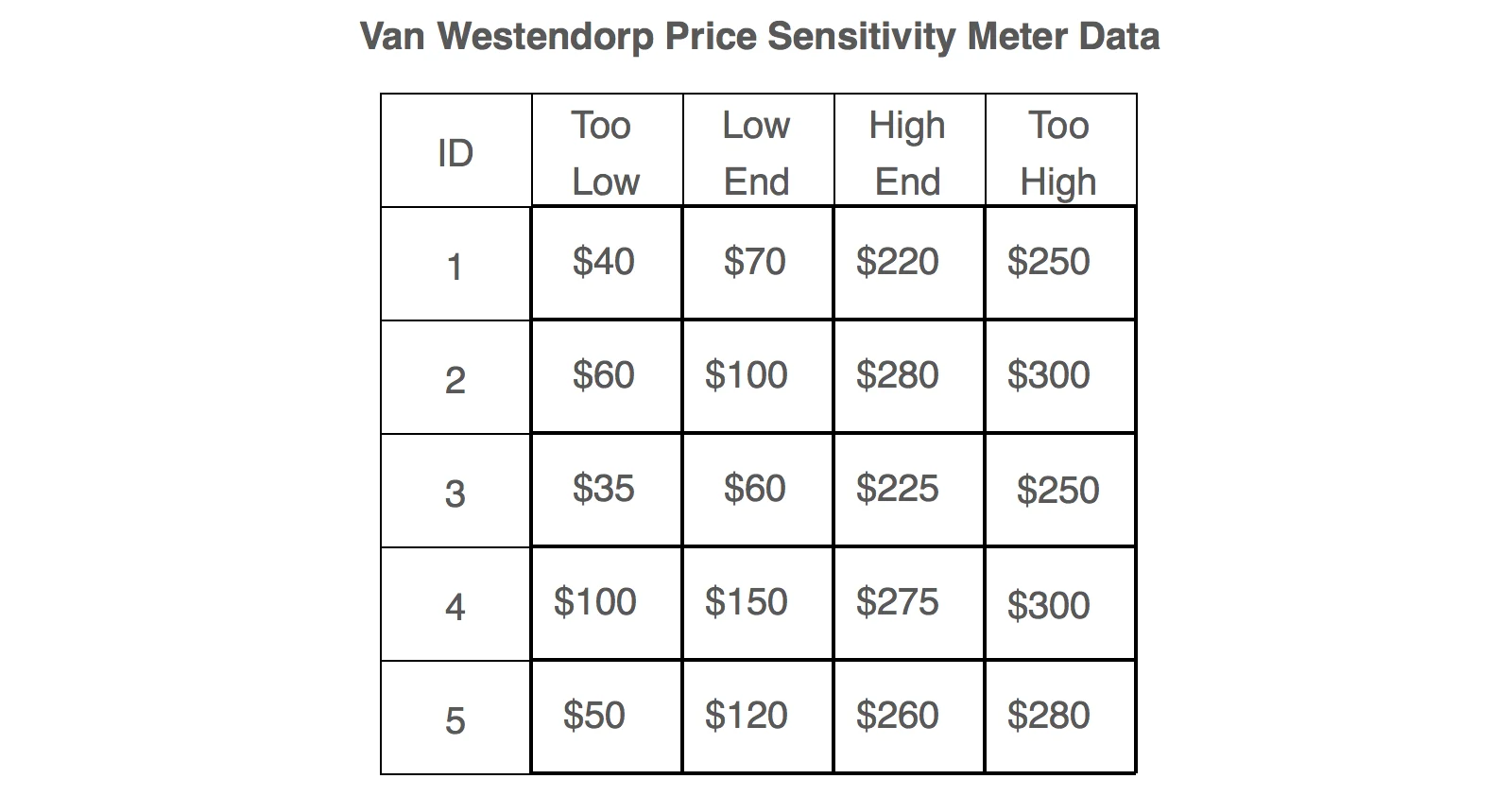

For a given product, ask customers in a particular buyer persona the following questions from Van Westendorp’s price sensitivity meter:

At what price would you consider the product to be so expensive that you would not consider buying it? This tells you a price point that is too expensive for this customer.

At what price would you consider the product to be priced so low that you would feel the quality couldn’t be very good? This tells you a price point that is too cheap for this customer.

At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? This tells you a high end of the range of acceptable prices for this customer.

At what price would you consider the product to be a bargain—a great buy for the money? This gives you a low end of the range of acceptable prices for this customer.

From these results, you’ll see that this buyer persona believes that a good price range for your cashmere sweater is between $100 (the average of the “Low End” responses) and $252 (the average of the “High End” responses).

These answers will provide you with concrete numbers to determine the optimal range for a product’s price according to the value the customer perceives.

5. Analyse Buyer Persona Data

Once you have answers about price sensitivity straight from individual customers, aggregate your data to find the best prices to drive sales for a particular buyer persona’s favourite product.

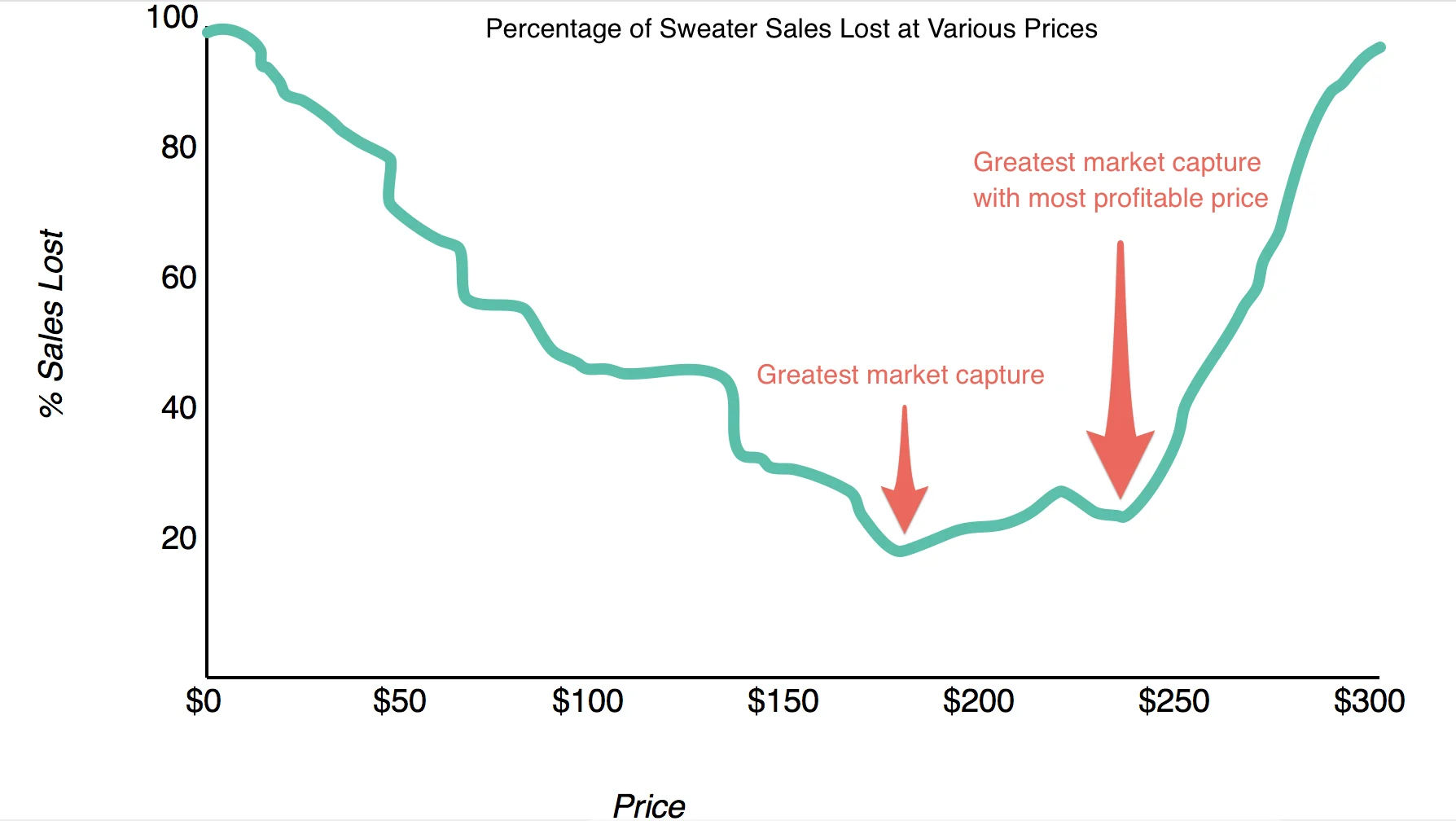

Graph the answers from Van Westendorp’s price sensitivity meter as a function of the percentage of customers who wouldn’t purchase above or below a particular price.

You can determine which price captures the largest share of your market with the most profitable prices:

At around $175, the least amount of sweater sales are lost due to price sensitivity.

This would be the best price for the sweater to capture the greatest percentage of this buyer persona.

Yet at $249, the sweater sale is much more profitable and only a small portion of the market is sacrificed — a large percentage of this buyer persona equates the value of the sweater with this price.

6. How Value-First Affects Your Marketing Material

Your price sensitivity analysis would lead you to conclude that you should price your sweater at $249.

This is the concluding takeaway of your analysis — an exact price point that tells you what your customers will pay for the value they see in a product. There is no hand-waving, no randomly chosen cost-plus margin, and no reliance on competitor pricing.

This process is straightforward, but the entire process could get lengthy if you perform it on an excessive amount of items. That’s why it’s so important to determine which products are most valuable to each buyer persona and to follow the 80/20 principle.

Once you have done this for a few different products, look for patterns in the data such as:

Are there certain types of customers who will pay more for certain products? Are there others who will pay less for particular products?

Which customers tend to make a lot of more expensive purchases? Which tend to make mostly less expensive purchases?

These patterns will allow you to adjust your marketing and advertising to more directly target customers who are interested in particular products. You can also begin to hypothesise about which types of customers will respond well to promotions, price adjustments, and certain price-sensitive marketing campaigns.

Value is King in Ecommerce

Value rules your pricing — so harness that power. Customer communication is the key to unlocking the information that you need. Now that you know the three-step framework, you can begin the process of value-based pricing and never look back.

Adjusting your pricing according to value will also make you realise how much customer experience and your company’s brand can play a part in the value a customer perceives in your product.

A customer-first approach and clear, strong communication will always improve value. Start creating more value for your customer in little ways, and you’ll see what a huge difference it makes across your business.