Please note, all references to “CBD” or “CBD products” within this post refers to hemp-derived CBD, not marijuana-derived CBD.

Companies in the cannabis and hemp space that don't take out CBD insurance coverage could face serious financial and legal repercussions.

Unforeseen events and circumstances, such as the hail storm that recently caused $25 million in damage to hemp crops across Central Oregon and the unexpected rise in insurance prescription claims that ate into 21% of Progressive Care's net gross margins reported for 2019, can seriously impact a business.

With this in mind, don't ignore the importance of seeking out a reliable provider of CBD insurance.

CBD — or ‘cannabidiol’ as scientists like to call it — is cropping up everywhere as of late, from pharmaceutical shelves and beauty cabinets to organic restaurants and even pet stores.

CBD is one of at least 113 cannabinoids that have been isolated from the cannabis plant.

The CBD industry is on track to earn the global economy $2.3 billion by 2025.

Interestingly, CBD can also be extracted from the hemp plant in copious quantities; a fact that has stirred up quite a predicament amongst business owners who want to abide by the law, but feel perplexed by CBD’s hazy legal status.

As demand for CBD-containing products continues to flourish, so too does the need for CBD product liability insurance coverage.

The complexities surrounding CBD legalities have left business owners in the dark about how to navigate the industry’s murky waters.

‘Cannapreneurs’ who advertise and sell CBD-based products, whether it is online, offline or both, simply must obtain CBD product liability insurance in order to shield their company from legal and financial pitfalls.

The FDA Will Not Tolerate CBD Health Claims

Nowadays, CBD is just as well known as its psychoactive cousin THC (tetrahydrocannabinol). After all, the naturally-occurring chemical compound has emerged as a therapeutic powerhouse, minus the mind-altering effects associated with THC.

In June 2018, the Food & Drug Administration (FDA) even went as far as to approve Epidiolex — the first ever cannabinoid-based epilepsy medicine to be approved by the FDA.

However, there is a serious lack of studies and clinical trials on humans to support the emerging forcefield of health claims being used by CBD marketers in an attempt to lure in customers.

CBD companies are forbidden from claiming that CBD can “diagnose,” “cure,” “treat,” “mitigate,” or “prevent” medical conditions like Alzheimer’s disease, anxiety, cancer, Parkinson’s disease and schizophrenia.

"Science forms the basis for decisions at the U.S. Food and Drug Administration (FDA) and is paramount when it comes to making decisions that will impact the health and safety of the American public," reads an official statement published on the FDA's website.

In spite of the Agency’s warning, many companies have not been discouraged from making claims that they are unable to prove. Take leading medical cannabis health and wellness operator Curaleaf, for example. The company was recently warned to remove all CBD health claims from their website and social media by the FDA.

A proactive compliance strategy will help protect you from FDA enforcement. So let us guide you through the legalities associated with selling cannabinoid-enriched products and enlighten you on the sheer importance of taking out a CBD liability insurance policy.

Why CBD Insurance Is a Necessity for Product Liability Claims

A long list of businesses fall into the high-risk category, including:

online gaming services,

vaping/e-cigarette companies,

and the adult toy industry, to name a few.

Since CBD is a compound that is produced in abundance by marijuana and hemp, it is inevitable that product claims may surface in the nascent CBD industry. This is a direct effect of the confusion that ensued following the passage of the Agricultural Improvement Act of 2018, better known as the 2018 Farm Bill.

In December of last year, President Donald Trump's signature effectuated the law, which removed hemp from the definition of marijuana under the Controlled Substances Act of 1970 and officially recognised the non-psychoactive plant as an agricultural crop.

This meant that instead of putting the Drug Enforcement Agency (DEA) in charge of overseeing crop regulation, the duty was instead bestowed upon the U.S. Department of Agriculture (USDA). The Farm Bill however preserved FDA’s authority.

Ultimately, this led some lawyers to make claims about CBD's legal status, with many falsely claiming that products containing the non-psychotropic cannabinoid could be shipped to any state without legal repercussions. According to the FDA, those attorneys stand to be corrected. A recent statement published by the FDA clarified this by informing the people of America that the agency maintains the right to regulate all CBD products, even those derived from hemp.

"We recognise the potential opportunities that cannabinoids could offer and acknowledge the significant interest in these possibilities. We’re committed to pursuing an efficient regulatory framework for allowing product developers that meet the requirements under our authorities to lawfully market these types of products," reads a statement from former FDA commissioner, Scott Gottlieb.

The importance of CBD product liability insurance cannot be ignored at such a fragile time. Although many industry analysts and a handful of pro-cannabis politicians remain hopeful that federal cannabis legalisation will ensue in 2020, existing federal restrictions on cannabis are stirring up smoke clouds of confusion among buyers and sellers.

You can safeguard your business by browsing CBD insurance companies for a policy that suits you.

What Is CBD Product Liability?

Rapid expansion of the CBD and hemp industries is prompting an elevated need for product liability insurance.

Without the assistance of an agent who is well-versed on the ins and outs of the industry, you may fall victim to a claim that could seriously damage your reputation as an industry seller, not to mention cause you financial implications.

Just because CBD product liability insurance was created specifically for companies operating in the marijuana and hemp space, it is no different than regular product liability insurance. In basic terms, CBD product liability insurance comes in handy when a consumer feels as though he or she has been harmed by a faulty product. The insurance coverage can be used to shield suppliers, producers and/or manufacturers when a claim of this kind is made.

4 Product Claims that CBD Companies Should Be Prepared For

In June 2018, British company GW Pharmaceuticals went down in history as the first ever drug company to gain FDA approval for a CBD-containing product.

GW Pharma's medicine Epidiolex was specially developed to aid patients two years and older who suffer from two rare types of epilepsy: Lennox-Gastaut and Dravet syndrome. The cannabinoid-based product is the only one to receive FDA approval so far.

Aside from Epidiolex, no other CBD medicines or treatments have been approved by the FDA. This means that any unsubstantiated health claims will be taken very seriously. Let's find out what product claims should be avoided to sidestep legal backlash.

1. Ingestible products.

Although it is suitable for ingestion, CBD reacts differently for each person depending on their specific biochemistry, genetics, gender, weight and so on.

This puts certain individuals at risk of experiencing unwanted side effects or allergic reactions if they take the wrong dose. Claiming that "one-dose-fits-all" is not recommended and could land you in serious trouble with the FDA. Contaminants can also impact health, which is why CBD products must be produced in accordance with regulatory rules.

According to federal policy, adding CBD to ingestible food products is not allowed. Doing so without authorisation is deemed to be just as serious as adding prescription drugs to food products. When health and/or therapeutic benefits are made about CBD, the CBD product could be subject to regulation as a drug.

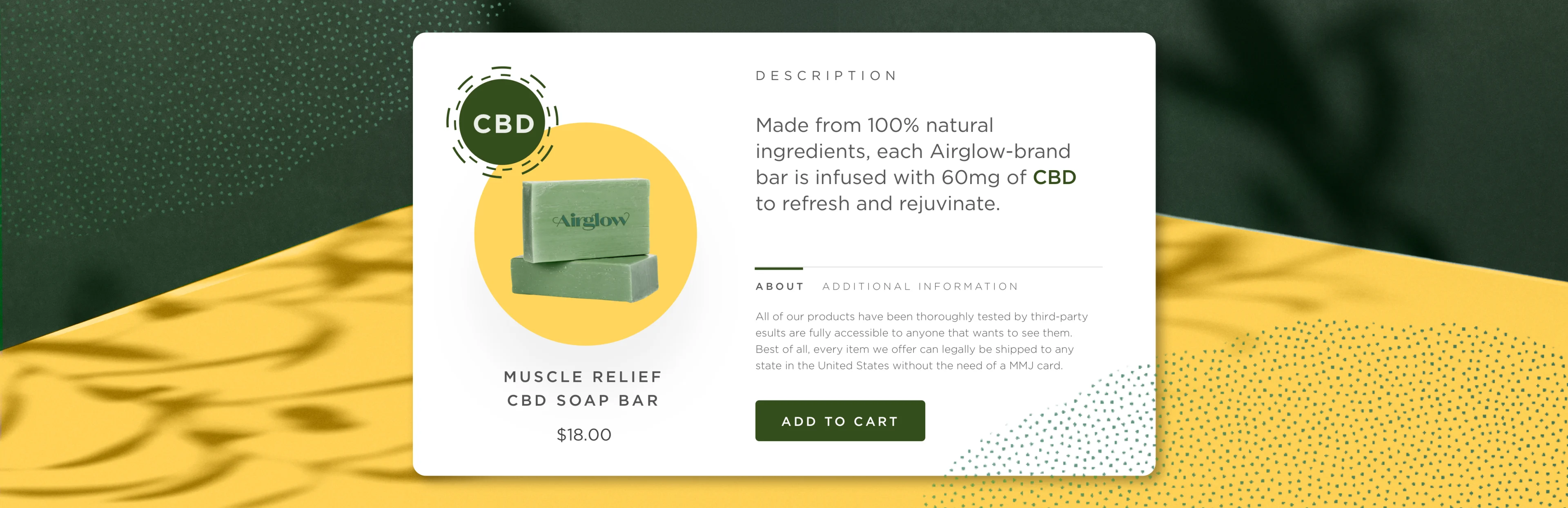

2. Topical products.

Some of the biggest national retailers, like Walgreens, Rite-Aid and CVS, have recently announced that they will start stocking store shelves with a range of CBD-infused cosmetic products.

The global cosmetics market is expected to be worth $805.61 billion by 2023 and, by adding an ingredient like CBD to the mix, the market is predicted to reach new realms of success.

However, insurance claims have surfaced in the past pertaining to contaminants and allergic reactions caused by topical CBD products, which may be applied directly to the skin for localised relief from pain. Once again, it is against the law to make unproven health claims due to the fact that the FDA has not yet given cannabis-derived compounds like CBD the go-ahead for use in animals, let alone humans.

Until the safety and effectiveness of topical CBD solutions are confirmed with clinical trials on humans, CBD business owners should not claim that their products can be used to relieve the symptoms of specific ailments, such as psoriasis, arthritis or chronic pain.

3. Medical claims.

Don't do a disservice to your company by making medical claims about CBD products that could essentially prevent individuals from visiting a licensed doctor for professional treatments.

Although scientific research has spotlighted CBD’s potential benefits as a therapeutic aid in recent times, making such claims could get you penalised by the FDA.

4. Legal disputes.

Don't fall into the trap of having to attend court to fight your case in the instance that a CBD product was shipped from your company in one state to a state with different laws.

Since CBD can be derived from the marijuana, which is still federally illegal, it is important to clearly stated that your product is derived from legal hemp.

According to the Controlled Substances Act (CSA), marijuana is still classified as a Schedule I drug and is said "to have no currently accepted medical use in treatment in the United States".

Many scientists, consumers and advocates would beg to differ, but it doesn't change the fact that cannabis is still a controlled substance and, until federal law changes, legal disputes will inevitably arise.

Ready to take the next step toward CBD ecommerce success?

CBD merchants face unique challenges when it comes to ecommerce. Download our guide to see how you can overcome them and begin to grow your CBD business online.

Areas of Expertise Focused on by CBD Product Liability Insurance Providers

"There are many unanswered questions about the science, safety, effectiveness, and quality of unapproved products containing CBD," says the FDA's new Commissioner Dr. Ned Sharpless.

CBD companies should take Sharpless' comments into account and prepare for the possibility of product liability claims arising. Being involved in this industry puts one at risk of general liability, product liability and theft.

With that being said, let's delve into the ways CBD insurance can help you to mitigate risk:

1. Risk management/aversion.

Cannabinoid-containing products are deemed to be a high risk due to their strict regulation by the FDA.

The changing winds of the CBD industry makes it tricky to stay abreast of the ever-changing legal landscape, which is where a CBD insurance company comes in handy. With guidance from advisors who possess industry knowledge, you can avoid publishing misleading information pertaining to the products your business sells.

2. Legal fees.

Nobody wants to be sued as a result of conducting unlawful business practices, but it's all too easy to slip up in the CBD industry and often, many business owners do it without even realising that they've made a mistake!

This is why you need hemp/CBD insurance coverage, which will usually cover the costs of legal fees and damages.

Consider it a shield that will protect you from the potentially devastating legal costs incurred by an unexpected claim. CBD insurance companies will provide compensation for lawsuits, whether the lawsuit is related to injuries sustained by employees in the workplace or issues that have arisen as a result of the products manufactured, distributed or sold in your ecommerce store.

3. Settlements.

In the unfortunate event that you are held liable in an unexpected court case, ask yourself if you would be capable of settling the case outright.

Of course, the answer to this question depends entirely on the situation at hand and the legal costs incurred.

Nonetheless, it is a risk that is definitely not worth taking. When you take out general liability insurance for your CBD business, you can rest assured that the legal costs will be covered by your insurance provider.

Keep in mind that the level of coverage depends on the provider and the type of policy you choose.

For the best level of protection, seek out a policy that covers the cost of claim adjustment expenses, court costs, compensation — however much is awarded to the plaintiff by the court — and the all-important lawyer fees.

The Two Main Types of CBD Insurance

Taking out CBD insurance coverage from a trusted provider is a necessity for business owners who want to avoid paying excessive costs to cover legal damages, should they be taken to court, have a claim filed against them or endure damages to company assets/stock.

Highlighted below are two of the main types of CBD insurance available:

1. Product liability coverage.

No matter how safe you are when conducting business practices, there is a chance you may unknowingly hurt consumers.

CBD consumers could suffer as a result of false health claims and/or defective products. In turn, the company that has a claim filed against them will also suffer, proving the importance of taking out adequate product liability coverage.

Product liability issues are a hot topic in the CBD industry right now, with an increasing number of claims being made against companies who have violated the terms of Proposition 65 - a law originally passed in 1986 that requires companies with 10 employees or more to clearly state what carcinogens and reproductive toxins (if any) are contained in their products

You can avoid being penalised for breaking the law if you integrate robust testing protocols into everyday business practices. This is especially important for product manufacturers, who could be faced with a lawsuit if they distribute CBD oils and related products that are contaminated or mislabeled.

Be extra prepared by taking out CBD product liability coverage. This type of CBD insurance will cover the costs incurred when a product claim is filed. Moreover, the insurance agents you work with will be able to point you in the right direction to ensure you don't make the same mistake twice.

2. General liability coverage.

This type of CBD insurance is part of the typical insurance system, regardless of what the insurance is being taken out for.

Coverage from a provider who focuses primarily on CBD industry clients will safeguard you and your business from liability risks associated with angry claims and lawsuits.

CBD general liability insurance will usually cover advertising damages, third-party personal injury and third-party property damage. Whatever role you assume as a CBD business owner, whether you are a retailer, wholesaler, extractor or cultivator, you will greatly benefit from this type of insurance policy.

Misconceptions and confusion enshroud the CBD industry, so general liability insurance is absolutely essential. It covers pretty much every risk faced by CBD business owners, so I guess you could consider it an all-in-one solution for mitigating risk!

4 Trusted Companies Offering CBD Insurance

Since it is relatively new to the mainstream, CBD carries certain risks that business owners must be aware of.

According to Trupanion, pet-related CBD and hemp product claims have climbed 300% from 2017-2018, with data from the medical pet insurance provider revealing how the majority of claims against CBD companies are pouring in from Florida, New Jersey, New York and Washington.

If your CBD products do not fall under the pet category but rather, are for human use/consumption, the following CBD insurance providers can assist:

1. Castle Rock Agency.

CBD product liability insurance options are available from Castle Rock Agency for as little as $3,000.

Whether you require premises liability for a manufacturing, distribution or retail facility, you can put your trust in this CBD insurance provider to shield the wellbeing of you and your business.

New, startup and established businesses operating in the industry can apply for coverage in the following target classes:

CBD-infused vape liquids.

CBD-rich dietary supplements and nutraceuticals.

CBD skin care.

CBD oils and tinctures.

CBD isolate.

CBD animal products.

CBD cosmetics.

CBD topical gels, lotions, salves and creams.

Concentrated forms of CBD.

Hemp oils and related products.

CBD-enriched drinks and drink mixes.

CBD hair care products.

Hemp-derived CBD edibles.

Primary insurance limits from Castle Rock Agency are available up to a maximum of $5,000,000, with excess limits of up to $20,000,000. Additional services are as follows, per the insurance provider's website:

Primary and noncontributory endorsement.

Hired and non-owned auto insurance.

Employment practices liability insurance.

Blanket vendors additional insured endorsement included.

Waiver of subrogation endorsement.

Damage to rented premises insurance.

Customers can also select from the many CBD insurance options pertaining to product recall expense coverages.

2. Veracity Insurance.

Companies operating in the CBD and or hemp industries can also obtain coverage from Veracity Insurance.

Veracity's team of helpful staff can aid you in your quest to find coverage with affordable minimum premiums, inclusive of product liability insurance, property insurance and crop insurance.

The minimum premium for topical CBD products is $2,500 and covers the following target classes, as per the company's website:

Baby skincare products.

Beauty accessories.

Candles.

Cosmetics.

Essential oils.

Hair care products.

Perfume and body fragrances.

Pre-made bases and materials.

Skin care products.

Spa supplies.

Toiletries.

Topical ointments.

Topical products for animals.

The minimum premium for ingestible CBD products is $3,500 and covers the following areas:

Ingestible supplements, vitamins, herbal or related products.

Compounded and non-compounded herbs.

Energy, protein and bodybuilding supplements.

Body cleansers.

Topical balms, salves and lotions.

Weight loss products.

Pet supplements.

Nutraceutical products.

3. Insurance Canopy.

No matter where you reside or where you operate your business, Insurance Canopy will not disappoint. The CBD product liability and general liability insurance provider aims to turn around all quotes within 24–48 hours.

Eligible policyholders must sell topical CBD and/or hemp products that do not contain more than 0.3% THC when applying for coverage from this CBD insurance company, which prides itself on providing the following:

$1 million occurrence.

$2 million product liability.

$2 million aggregate limits.

In-house underwriting.

Limits up to $50 million.

Inland marine coverage.

Hired/non-owned auto coverage.

Employee benefits liability.

Trade show coverage.

Product withdrawal coverage.

Low minimum premiums are guaranteed for all coverage holders. Additional insured vendors endorsements are also included in the CBD insurance coverage you take out from this provider. With worldwide coverage and low deductible options on offer, it is well worth booking a consultation with Insurance Canopy to learn more about their services.

4. New Growth Insurance.

This well-respected CBD insurance company covers a wide range of scheduled cannabis, CBD and hemp products. It is their duty to defend and assist you in every way possible, from providing product withdrawal reimbursement of expenses, to making sure you don't pay anything for waivers of subrogation or primary wording.

Multiple deduction options are available with New Growth Insurance, which provides commercial product withdrawal coverage approval for the following classifications:

Cultivation (indoor and greenhouses).

Manufacturers.

Retail.

Management offices.

Garden/hydroponic stores.

Coverage Options:

$1,000 (only offered on $100,000 limits).

$5,000.

$10,000.

$25,000.

$100,000 aggregate.

$1,000,000 aggregate.

$2,000,000 aggregate.

Conclusion

When it comes to running an online ecommerce business featuring an inventory that primarily consists of CBD products, it is imperative that you don't step on the FDA's toes.

Legislation enacted under the terms of the Agriculture Improvement Act of 2018 (Farm Bill) meant that the FDA maintains full responsibility over hemp derived products that are foods, dietary supplements, cosmetics, or drugs, among other products. The FDA's stance on cannabis remain the same as is for any other substance.

Staying out of trouble in regards to advertising, marketing and selling ingestible or topical CBD products online is possible. CBD product liability insurance will be a valuable tool, but it does not prevent enforcement. Further, FDA warning letters are made public. Getting on the wrong side of the FDA can land you in serious trouble and tarnish all of your hard work. With some jurisdictions having outlawed CBD in its entirety, it really doesn't hurt to be prepared.

Product liability insurance coverage could safeguard your finances and the livelihood of a business in this avenue, should a claim be filed regarding faulty design, manufacturing, instructions and warnings.

So, why not do something today that your future self will thank you for? We’ve provided the knowledge and tools you need to conduct safe ecommerce practices; now you just need to execute a CBD insurance strategy that begins with picking a provider.

Don't be afraid to reach out for more information and, of course, share this post to enlighten fellow merchants of the rules!

This material does not constitute legal, professional or financial advice and BigCommerce disclaims any liability with respect to this material. Please consult your attorney or professional advisor on specific legal, professional or financial matters.