Historically, alcohol and ecommerce have shared a strained relationship in the United States, due in no small part to the various regulations and legal restraints placed upon them.

But all of that changed with the introduction of COVID-19 into the United States in March 2020 and the succeeding lockdown. Americans found themselves separated from bars and restaurants — and it did not take them long to find a solution to quench their thirst.

A new report by IWSR Drinks Market Analysis states that the global ecommerce market for spirits and wine increased by nearly 43% from 2019 to 2020.

This significant increase serves to highlight the incredible growth experienced by the alcohol ecommerce industry — growth that does not show any signs of slowing down. In fact, according to Statista, online alcohol revenue in the United States is projected to increase nearly threefold from 2020 to 2025.

As alcohol ecommerce continues to evolve, organizations must understand the changes that are taking place and why. Read more to learn how to face challenges head-on and boost alcohol sales to match a rapidly changing industry.

How D2C is Changing the Alcohol Industry and Ecommerce

Direct-to-consumer (D2C or DTC) is a business strategy in which a company markets or sells products and services directly to the consumer, without the need for any middlemen.

While DTC is not a new strategy within the broader American marketplace — it has become a favoured way of targeting millennials — there have historically been legal and cultural challenges which have prevented the alcohol industry from utilising this channel.

However, as the coronavirus pandemic persists and more shoppers turn to the online marketplace to make alcohol purchases, these limitations are breaking down and providing a significant opportunity for alcohol brands nationwide.

The following benefits highlight this newfound opening:

1. Lower entry barriers.

When it comes to online ecommerce, the barriers to entry are quite low. This is especially true for alcohol companies. What is their path to success? It’s simple: finding supply and having a way to deliver.

Ecommerce sites that are unattached to liquor or grocery stores are also gaining popularity by tapping into this growing market. Brand-agnostic companies such as Saucy and Instacart have gained popularity by crafting easy-to-use applications and allowing consumers to shop beyond specific retailers when buying alcohol.

2. Easier to control the customer experience.

With physical stores, liquor store merchants don’t have the kind of control they may prefer for customer service. Each interaction is unique and uncomfortable moments can be challenging to prevent.

With D2C, however, retailers have the chance to change the way they are perceived and revamp the customer experience. An online and ecommerce store can be a blank slate, allowing retailers to connect with customers in a way that was previously inaccessible.

We all know how valuable the customer experience is. A streamlined, easy-to-use platform can make all the difference in the world.

3. Optimized distribution and increased access.

Depending on where you are located in the United States, alcohol home delivery can be tricky. It is still illegal to get alcohol delivered to your home in some states, while in others it is actively encouraged.

Online services can help both retailers and consumers track where alcohol delivery services are available and the associated costs. Instead of relying on individual physical locations, ecommerce platforms can work within different states and legal systems, allowing for a greater consumer base.

Delivery and Shipping for Your Alcohol Ecommerce Business

As stated above, one of the most significant difficulties facing ecommerce businesses and alcohol retailers is that every state in the U.S. has its own unique set of legal challenges concerning the sale of alcohol.

A remnant of the old post-Prohibition policies aimed at collecting taxes and preventing alcohol-based crimes, these laws have proved challenging for ecommerce providers looking to expand into the alcohol industry.

But since 2020, as customers pivoted to online sales in greater numbers, the legal constraints have slowly relaxed. However, It is still critical that ecommerce companies understand the issues they are facing and how best to confront them.

1. Interstate shipping.

With the growth of ecommerce and online alcohol sales, many states have begun to allow retailers to use common carriers such as UPS and FedEx to reach customers outside of the local alcohol marketplace and into different states. This growth of interstate shipping has provided a once-in-a-generation opportunity for alcohol distributors and importers.

Alcohol providers must be cognisant of different compliance issues across borders. There are states that still have dry counties where shipping is prohibited or restricted. Organizations must do their due diligence in maintaining a quality, legal shipping environment.

Here are some shipping regulations for each state to follow.

2. Local on-demand delivery.

As the demand for online-based alcohol delivery increased, so did the need for local on-demand delivery. Organizations and startups like Drizly took advantage of this opening in the market, doubling their retail partners by the end of 2020.

Delivery companies recognised a place in the market for alcohol delivery and pounced upon it. Rather than running to the local liquor store for alcohol, consumers can use an app to order their goods and receive them an hour later. Ordering online expedites the process with easy-to-use transaction systems and can even open up a more extensive selection of alcoholic beverages for customers.

The rapid growth of online sales quickly caused states such as Georgia and Arkansas to relax alcohol delivery, giving shops in those states an immediate growth opportunity. These delivery sales weren't nearly as disruptive to the local model as many anticipated, belaying many of the fears that physical stores had.

3. Curbside pickup.

Once seen as a peculiar side effect of the early pandemic, curbside pickup has proven to be a valuable service for retailers and consumers. Instead of entering the store to find products, customers can order alcohol online and simply pick it up from the curb, expediting the entire process.

Curbside pickup is a subset of the Buy Online, pickup in store (BOPIS) model that has achieved significant success over the last decade. The restrictions on curbside pickup and BOPIS models are much less strenuous than delivery.

For organizations wanting to bridge the gap, this is an opportunity to increase sales, while maintaining the face-to-face customer experience.

Alcohol Ecommerce Trends

Several significant trends began to emerge in 2020 regarding alcohol ecommerce. Long thought to be a thorny industry — one that many companies and states have stayed away from — online alcohol services have proven to be a boon for many struggling retailers or small ecommerce platforms.

The following trends have highlighted how alcohol ecommerce may be here to stay — and could one day even surpass the success of physical stores.

1. Physical vs. Online Sales.

From 2019 to 2020, overall alcohol sales decreased from $252 billion in 2019 to $222 billion in 2020.

However, while alcohol sales diminished on the whole, the IWSR says that the American alcohol ecommerce market value grew by nearly 80% between 2019 and 2021.

The incredible growth of online sales, especially as overall and in-store sales have faltered, highlights the increasing capability and relevance of alcohol ecommerce within the market.

As more consumers move to online shopping, companies that rely on physical locations such as wineries or distilleries may need to consider a broader shift to ecommerce platforms.

2. Success despite lack of funding.

Alcohol ecommerce has succeeded over the past year and a half past what most experts anticipated, especially considering the overall lack of funding.

From 2018 to 2020, U.S. alcohol ecommerce funding dropped by more than half, going from $278 million down to $132 million. Despite this lack of funding, alcohol ecommerce had a significant spike in sales.

What does that mean for the future? Contrary to the previous consensus, it may indicate that online alcohol shopping is finally beginning to catch up with other services such as grocery delivery. Alcohol providers have already begun to take notice, with an increase in funding in 2021 of more than $50 million. As we go further into the 2020s, it will not be surprising to see the resilient industry gain even funding as it proves to be a potential cash cow.

3. Major acquisitions.

Within the first quarter of 2021, several major companies began to acquire or expand their alcohol ecommerce activity, including Uber, Vivino and Vintage Wine Estates.

This is a far cry from the lack of funding in the past and appears to indicate that organizations are seeing the results of the last year and a half to prioritise their businesses. As alcohol ecommerce continues to grow, watch for more organizations to do the same.

Alcohol Ecommerce Challenges

The growth of alcohol ecommerce has been incredible, allowing companies to expand their markets and increase sales far more than anticipated a year removed from a nationwide lockdown.

However, there are still potential struggles and risks involved with it. In order to prevent broader mistakes, it is valuable for companies starting their ecommerce journey to know what they are getting themselves into.

1. Licensing protocols.

Licensing, a word that can haunt the dreams of any alcohol provider. It is essential that organizations understand the full breadth of licensing before undertaking online shopping.

Are you able to sell alcohol online? What does it take? What brands are allowing online sales, and where are they able to be sold?

These are questions that must be answered.

2. Shipping alcohol.

Shipping alcohol was once highly regulated and often quite illegal. As states begin to loosen restrictions, there is now a path for ecommerce providers. Even Amazon, long hesitant to get into alcohol delivery, has begun pilot programs.

Each state is different, however. A challenge for any organization is understanding how states differ and which shipping service they can use.

3. Underage purchases.

The most significant risk of online alcohol shopping is that the alcohol ends up in the hands of underage buyers. Young children often have cell phones of their own or play with their parent’s devices. Is it that difficult to imagine a teenager ordering alcohol via cell phone?

It is critical for the viability of online shopping that ecommerce providers have a way to deliver products safely to adults, whether it is through trained delivery drivers and pre-order verification.

How to Boost your Alcohol Ecommerce Sales

Over the last year and a half, alcohol ecommerce has surged in popularity as online shopping continues to grow throughout the United States.

This is no longer simply a trend but a glimpse into the new normal of alcohol sales. As consumer behaviour continues to evolve toward the online market, organizations that have not begun to pivot will find themselves falling behind sooner rather than later.

By understanding what’s happening in the industry and how to keep up, alcohol providers can boost their alcohol ecommerce sales and take a step into the future.

1. Understand regulations.

Before diving into the world of ecommerce, alcohol providers need to ensure that they understand regulations surrounding alcohol. Each state has different regulatory practices, and each can prove a headache for an unaware retailer.

By integration monitoring solutions across retail channels and focusing on the intricacies of delivery apps, organizations can stay on top of troublesome regulations.

2. Provide a frictionless purchase experience.

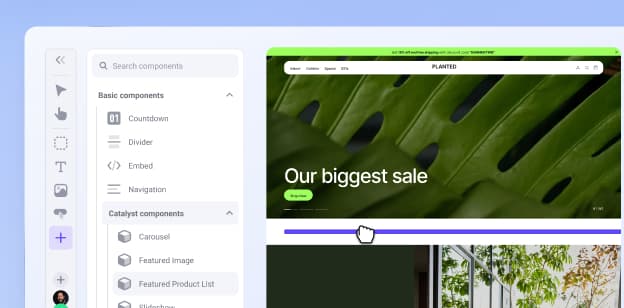

The easiest way to maintain and grow a customer base is by providing an easy, simplified buying experience. An easy-to-use application with a streamlined interface and a simple purchasing process can make all of the difference in the world.

It is easy to overthink online shopping, but it doesn’t have to be.

3. Know the data.

In a technological world, data is king. Organizations must ensure that they have unfettered access to quality data from all of their channels to leverage insights at each point in the buyer’s journey. Knowing your customers, what they like and how to get them there is critical to the success of an online platform.

Owning the data of your competitors is essential as well. You will never gain an edge in the market if you do not understand what your competitors are doing. Playing catch-up is a pain -- by prioritising data insights, you can get ahead of the game.

4. Pivot to omnichannel.

The way the modern consumer shops has diversified over the last decade, as online shopping has grown in relevance and capability. Whether it’s shopping solely online, in-store or a variety of adjacent models such as curbside pickup, the options are growing and can make pinning down a strategy complicated.

A solution to diverse shopping methods is omnichannel commerce. A multichannel approach to sales, the omnichannel method provides a seamless customer experience whether a customer is shopping online, in-store or even both. It is not about any single option but crafting an ecosystem that allows for all possibilities.

A robust omnichannel strategy that can successfully blend ecommerce and physical retail is the future of alcohol ecommerce.

The Final Word

In 2020, 44% of shoppers purchased their alcohol online compared to only 19% in 2019, with the number growing even further in 2021.

We are in a whole new world regarding alcohol ecommerce, due to a growing awareness of online shopping. Consumers are discovering more than ever before that purchasing alcohol online is simple, convenient, and can save a trip to the store.

As such, alcohol-based organizations across the United States have begun to pivot en masse to ecommerce sales, from smaller, regionally-based retailers to nationwide chains.

The rise of alcohol ecommerce has heralded the way of the future, and presents a unique, reachable opportunity for alcohol retailers nationwide.